08 April 2025

Thinking About Opening a Sligo Credit Union Current Account?

If you're looking for a reliable and affordable way to manage your finances, a current account with Sligo Credit Union might be just what you need. Now available to Boyle and Keadue members, this account provides a cost-effective alternative to traditional banking while offering the essential features you expect. But is it the right choice for you? Let's break it down.

Why Choose a Sligo Credit Union Current Account?

- Affordable Fees

Unlike many high-street banks that charge hefty fees for account maintenance and transactions, the Sligo Credit Union current account keeps costs low with a simple €4 monthly maintenance charge. There are no hidden fees, making it easier to manage your finances. View our current account comparison chart. - Access to Online and Mobile Banking

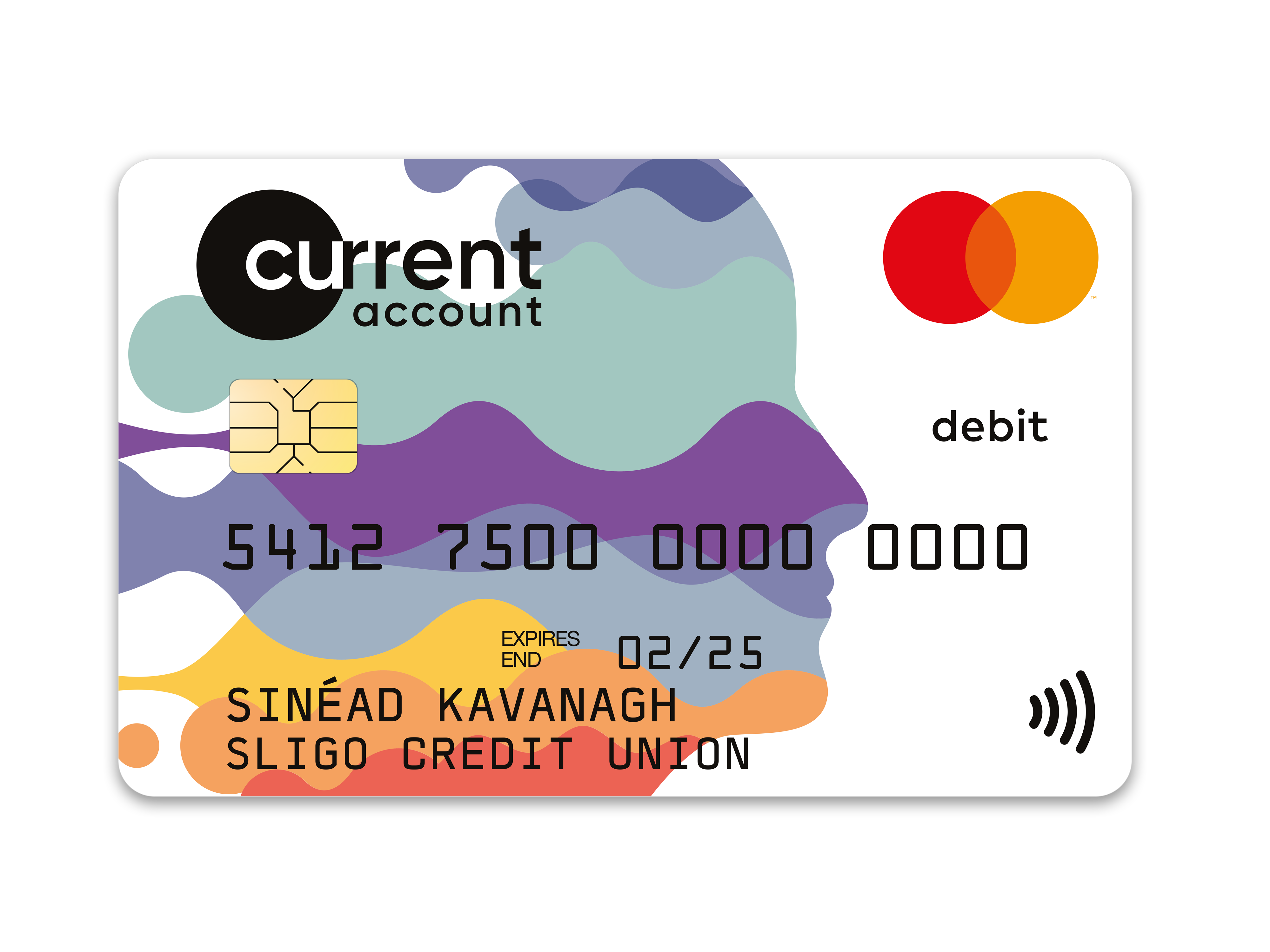

The account comes with online banking, and through the Sligo Credit Union mobile app, you can track your spending, check balances, transfer money, and pay bills on the go. - Tap & Go with Contactless Mastercard Debit Card

You’ll receive a Mastercard debit card that enables contactless payments, ATM withdrawals, and online purchases both in Ireland and abroad. - No Surprises - Transparent Charges

With clear fee structures, you can avoid unexpected charges for day-to-day banking activities like direct debits, standing orders, or ATM withdrawals. View our full charges. - Local and Community-Focused Banking

Credit unions operate as member-owned financial cooperatives, meaning profits are reinvested into services for members rather than shareholders. By choosing Sligo Credit Union, you’re supporting a community-focused financial institution with branches in Sligo, Leitrim, and Roscommon.

Who Is This Account Best Suited For?

✔ If you want a low-cost alternative to mainstream banks

✔ If you value local banking with personalised customer service. Our Member Service Centre is contactable six days a week at info@sligocu.ie or 071-9317500.

✔ If you prefer a transparent and simple banking experience

✔ If you are looking for an everyday banking solution with online access and a debit card

If you resonate with most of the above, then opening a Sligo Credit Union current account could be a smart financial move.

How to Open an Account

Opening a current account with Sligo Credit Union is straightforward:

- Check Your Eligibility - You must be a member of Sligo Credit Union. If you're not already a member, you can join by providing an updated proof of ID, address, and PPSN. See requirements.

- Complete an Application - This can be done online via our website or app, or in-branch.

- Provide Supporting Documents - Standard banking regulations apply, so have an acceptable proof of identity and address ready.

- Receive Your Debit Card and Online Banking Details - Once approved, you’ll receive your Mastercard debit card and online banking access.

Final Thoughts

For just €4 per month*, a Sligo Credit Union current account provides a great balance of affordability and convenience. It’s ideal for those who want a straightforward, community-based banking option without the high fees often associated with traditional banks.

Join nearly two thousand satisfied members, open your Sligo Credit Union current account today, and experience affordable, community-focused banking!

Sligo Credit Union Branches

📍 Sligo Branch, Wine Street, Sligo, F91 KXY6

📍 Boyle Branch, 7 Green Street, Boyle, Co. Roscommon, F52 DF70

📍 Collooney Branch, Main Street, Collooney, Co. Sligo, F91 NP26

📍 Drumkeerin Branch, Main Street, Drumkeerin, Co. Leitrim, N41 K5D1

📍Keadue Branch, Keadue West, Co. Roscommon