19 February 2024

Educational Bursary Awards - 2024 Winners!

Sligo Credit Union was delighted to award ten third-level students €1,000 each to go towards college-related expenses again in 2024. Since the bursaries' inception 17 years ago, approximately €170,000 has been awarded to college students.

At a small awards ceremony held in Sligo Credit Union, 2024’s Educational Bursary Award winners collected cheques, including students from ATU Sligo, DCU and Trinity College Dublin. As third-level education costs continue to take their toll on students in Ireland, and with finance being a significant aspect of third-level life, it is Sligo Credit Union’s priority to help members as much as possible.

Congrats to 2024 winners:

✔️ Bryce Scales

✔️ Cliodhna Davitt

✔️ Dean Osborne

✔️ Eabha O'Grady

✔️ Eve McEvoy

✔️ Jennifer Smith

✔️ John Hanbury

✔️ Michelle Scanlon

✔️ Sarah Kisby

✔️ Katie McGoldrick (not pictured)

Pictured from top - bottom, left - right: Bryce Scales, Cliodhna Davitt, Nochette Osborne (standing in for her son Dean), Eabha O'Grady, Eve McEvoy, Eileen (standing in for her daughter, Jennifer Smith), John Hanbury, Michelle Scanlon and Elizabeth King (standing in for her daughter, Sarah Kisby).

Education Loans

In addition to offering Education Bursaries, Sligo Credit Union provides an affordable and discounted Education Loan rate of 6.96% APR* for college-associated expenses. It is important that students know a credit union loan is a far less expensive way to borrow money for college than using a credit card or going to a moneylender.

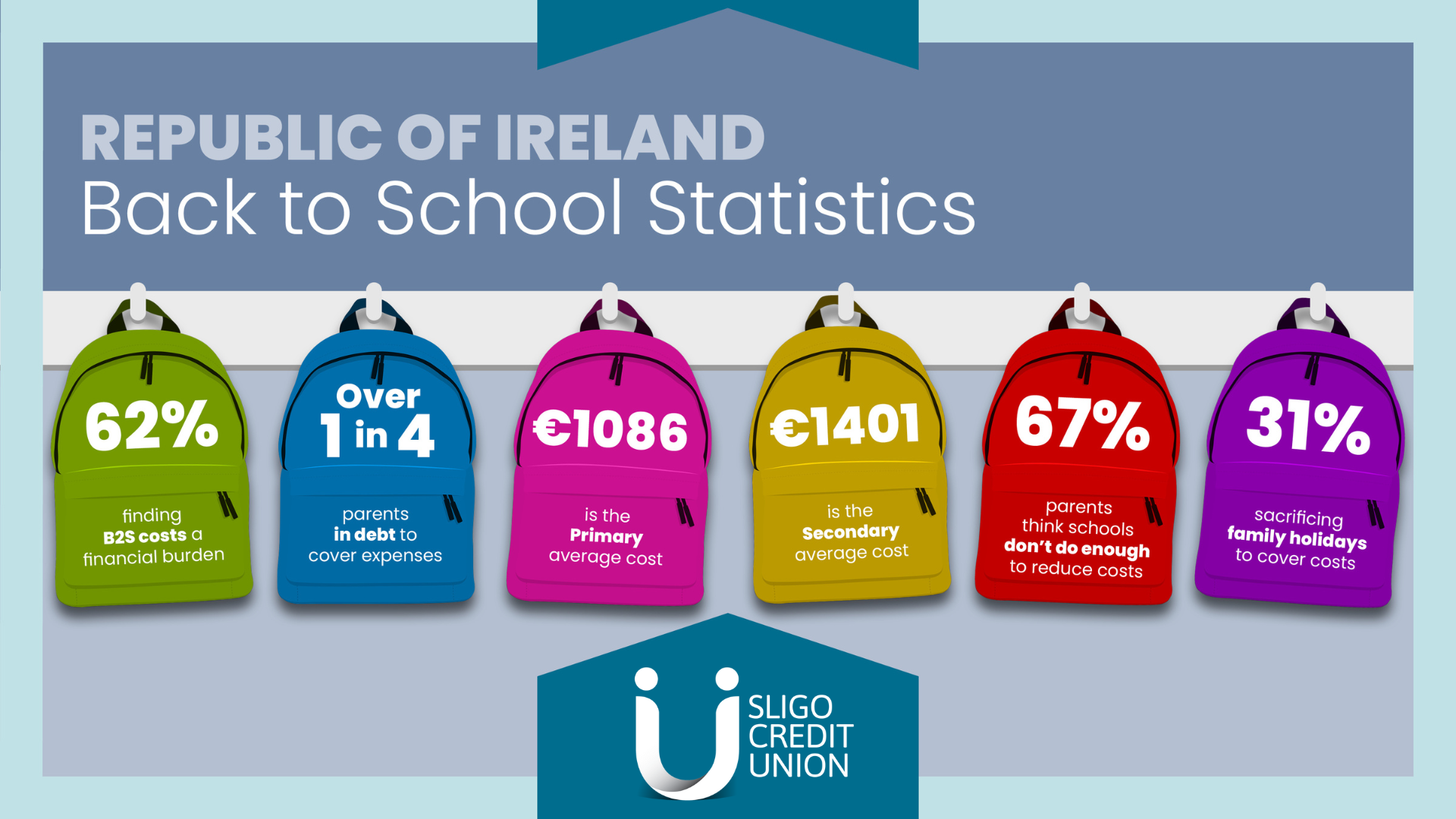

Sligo Credit Union’s Chairperson, Shona Heffernan, explains that they want to do as much as possible to ease the financial burden of third level. “We are keenly aware of the huge financial burden that third-level education places on students and their families in the Sligo area. We understand that because of the significant costs involved, many have no option but to borrow. We are always happy to work with students to ensure loan repayments are structured in the best way possible for their circumstances. There are never any hidden payments or transaction fees with a student loan.”

Shona continued: “As ethical lenders in Sligo Credit Union, we will never recommend that the student borrows more than they can repay or that the loan will put them in unnecessary debt. We are not-for-profit, so our only motive is to help the student and not to profit from their needs. So, we would really encourage students in the Sligo / Leitrim area to come and chat with us if they need a loan to get them through college.”

*Education Loan Representative Example:

For a €5,000, 3-year variable interest rate loan with 36 monthly repayments of €154, an interest rate of 6.75%, and a representative APR of 6.96%, the total amount payable by the member is €5,537. Information is correct as of 09/02/2024.

*Missing from the photo is Katie McGoldrick.

**Terms and conditions apply. Loans are subject to approval. If you do not meet the repayments on your credit agreement, your account will go into arrears. This may affect your credit rating, which may limit your ability to access credit in the future. Sligo Credit Union Ltd. is Regulated by the Central Bank of Ireland.

Education Loan